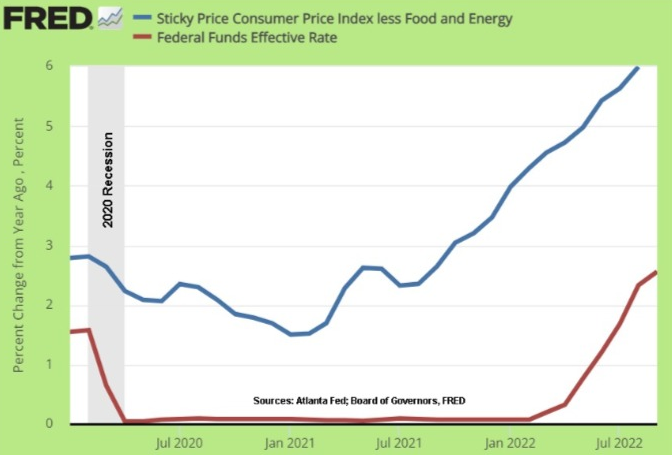

The Federal Reserve is at war with economic instability, a battle in which returning to “normal” will involve sizable costs. As the federal funds rate has grown, borrowing costs have increased, thus changing CRE economics.

“Property investors had just adjusted to a 3% Treasury yield, but now they’ve got to deal with much higher rates,” said Peter Rothemund, Co-Head of Strategic Research at Green Street. Speaking in October, he added that “cap rates may not move as much as Treasury yields, but they’re likely to go 50 bp higher, perhaps more. It’s going to depend on whether the rise in interest rates sticks, and how weak economic growth gets.”

“We are in this for as long as it takes to get inflation down,” said Fed Vice Chair Lael Brainard in late September. “So far, we have expeditiously raised the policy rate to the peak of the previous cycle, and the policy rate will need to rise further.”

NPR explains that back in the early 1980s, Fed chairman Paul Volcker “slammed the brakes on the economy by raising interest rates to 20% — tough medicine to prove he was serious about getting inflation under control.”

Not only did interest rates soar with the Volcker approach, so did unemployment.

This time around, however, the situation is likely to be different. Here’s why:

- In September 2022, unemployment reached 3.5%, a rate close to long-time lows. Government figures show there were 10.1 million job openings in August and just 5.8 million unemployed. Steep unemployment levels from the Volcker era are unlikely today because of the huge number of available jobs.

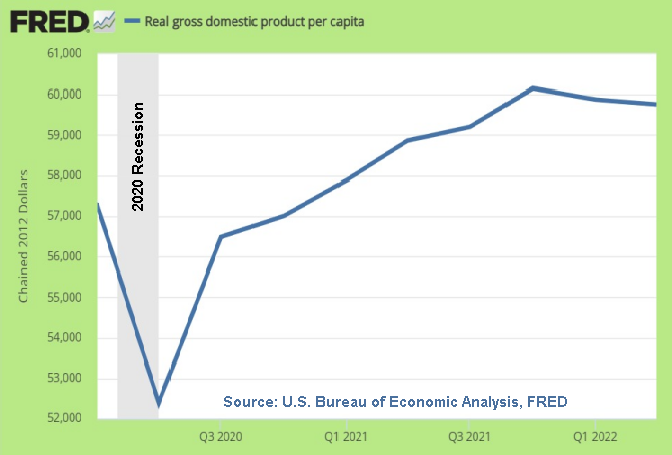

- America remains an economic powerhouse. Real gross domestic product per capita went from $52,394 in the depths of the 2020 recession to $59,756 in mid-2022 — a figure higher than even the pre-pandemic peak of $58,017. More household income creates additional demand for commercial real estate. However, as the chart shows, while growth has been significant since 2020, the economy slowed at the start of 2022.

The continuing supply chain issue

Demand for electric vehicles is soaring, but supply is not. Ford reports that in the third quarter it will have more than 40,000 unsold vehicles; unsold not because demand is down but because the company is “lacking certain parts presently in short supply.” Ford expects to pay an additional $1 billion for supplies as a result of inflation and shortages. And what will it do in return? According to The Street, the base price for a Ford F-150 Lightning Pro has gone from almost $40,000 in May 2021 to roughly $53,000 in 2023, an increase of 32%.

Like Ford, many companies are facing supply chain problems. They can’t sell what they can’t produce, and prices are soaring, contributing to inflation trends the Fed can’t control.

While bottlenecks at West Coast ports have largely been cleared up, supply-chain issues remain. The “just in time” manufacturing concept has become iffy, in part because huge cities in China have randomly closed down under the country’s “zero-Covid” pandemic response.

The result of supply-chain instability is that logistical thinking has begun to evolve. Production is being brought back to the U.S., meaning new demand for manufacturing and warehouse space, as well as supporting businesses.

Evolving labor trends

As expected, the work-from-home (WFH) movement has shifted, dividing office users into three essential groups.

- Those who generally require full-time office hours, such as Tesla.

- Organizations that have adopted “hybrid” or “flexible” schedules for qualified employees, including CVS Health and DocuSign.

- Those who are largely moving toward remote work, such as PwC and Reddit.

Data from Kastle Systems shows both that WFH remains strong, but also that office usage is up. It reports that weekly office occupancy stood at 47.2% in ten major markets in early October, compared with 25.7% two years earlier.

In a new white paper from the Mortgage Bankers Association, it’s explained that “there are those who see in a remote/hybrid work future a one-for-one reduction in the need for office space. There are also those who see a situation in which — driven by the desire for collaboration — companies maintain space to allow the full employee-base to be in at the same time.

“As is often the case,” they add, “the results are likely to be somewhere in the middle and driven both by changes in the number of employees in the office at any given time and by the types of space those employees need.”

Gallup takes a somewhat different view. The global analytics and advice firm found It’s not so much where you work as the social benefits available there.

“Spending less time at a toxic workplace is certainly going to feel better,” reports Gallup. It adds that an “analysis of employee burnout has found that how people experience their workload has a stronger influence on burnout than how many hours they work. And when it comes to overall wellbeing, the quality of the work experience has 2.5 to three times the impact of the number of days or hours worked.”

One has to look at the highest and best use of office space to determine present and future use. In general terms, we will likely see ongoing demand for new or revitalized Class A structures, but less demand for older space. In some cases, this will open up the possibility for conversion to residential use, especially for properties with premium locations near entertainment and shopping.

Other factors looming on the horizon

Looking ahead, questions remain over the long-term impact of the pandemic; damage from violent hurricanes and the resulting devastation of wildfires have left many wondering how environmental challenges will impact the economy; and, the war in Ukraine and a recession in China continue to threaten the global stability.

The answers to these and so many other questions are yet to be determined. Perhaps we’ll all know more by 2022’s end, when a new year of challenges and solutions present themselves.

Learn more about commercial real estate, visit KBS.com/Insights.