Inflation represents generally-higher prices over time for a wide range of goods and services. Such increases are not necessarily harmful.

The Federal Reserve tries to keep inflation near 2% a year. It’s enough to assure that people buy goods and services now rather than face higher prices in the future without an excessive currency devaluation. This “buy now” use of inflation spurs current economic growth and helps maintain the job base.

“When households and businesses can reasonably expect inflation to remain low and stable,” says the Federal Reserve, “they are able to make sound decisions regarding saving, borrowing, and investment, which contributes to a well-functioning economy.”

Unfortunately, low and stable inflation levels left us in 2021. The pandemic, supply-chain delays on the West Coast and in China, the chip shortage, OPEC efforts to raise oil prices, and the war in Ukraine all contributed to the soaring inflation levels we’ve recently seen.

Figures show that the annual inflation rate in the U.S. was 1.8% in 2019, 1.2% in 2020, and 6.8% in 2021 — more than five times the 2020 inflation level. In 2022 things got worse. The annual inflation rate in June reached 9.1%, the largest 12-month increase in 40 years.

Past inflation solutions

In the late 1970s and early 1980s, inflation hit with a vengeance. Residential mortgage rates averaged 16.63% in 1981, according to Freddie Mac, and many blamed the Federal Reserve for the debacle. The so-called Great Inflation came to an end under Paul Volker, then Chairman of the Federal Reserve, but residential mortgage rates did not fall below 10% until 1991.

“Volcker,” explained Vox.com, “got inflation under control through the economic equivalent of chemotherapy: He engineered two massive, but brief, recessions, to slash spending and force inflation down. By the end of the 1980s, inflation was ebbing and the economy was booming.”

How the current inflation rate affects economics

This time around the country instantly faced both a health crisis and an economic one as the Covid pandemic unfolded in early 2020. Commercial properties nationwide emptied out as millions of people began working from home — or didn’t work at all.

According to Kastle, commercial office usage in ten major markets in 2020 went from 99% during the week of February 12 to 14.6% for the week of April 15. The Bureau of Labor Statistics reported that “after reaching a peak in February 2020, employment fell by a combined 22.4 million in March and April, a decline of 15 percent.”

With hospitals filling up, the times were replete with serious talk of possible economic decline.

“We’re headed into a global depression,” said Ian Bremmer, president of the Eurasia Group, a political-risk consultancy, writing in Time magazine. It will be “a period of economic misery that few living people have experienced.”

The government needed to respond and it did. According to the Peter G. Peterson Foundation, the government pumped out more than $5.3 trillion in pandemic relief for such efforts as the Paycheck Protection Program (PPP) for small businesses, economic stimulus payments with checks sent directly to millions of households, and expanded unemployment benefits. Unfortunately, flooding the marketplace with massive amounts of cash likely saved the economy, but at the same time, added to the inflationary spiral we see today.

What about a recession?

Is there now — as was the case with the Great Inflation — a full-blown recession in our future, something to choke off inflation?

The answer is unclear, but three options are being widely discussed.

Yes, a hard recession is a sure bet in 2023.

Billionaire investor Stanley Druckenmiller, according to CNBC, said at the network’s Delivering Alpha Investor Summit in September that “I will be stunned if we don’t have recession in ’23. I don’t know the timing but certainly by the end of ’23. I will not be surprised if it’s not larger than the so-called average garden variety.”

Maybe there will be a recession, but nothing major.

There are many commentators who suggest we’re likely to face a “soft landing,” a sort of recession lite, for three reasons.

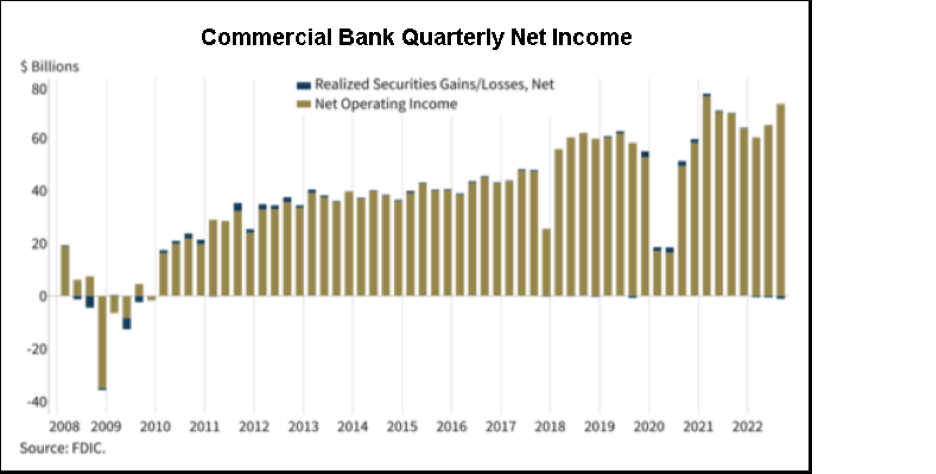

First, the country was doing well in 2022, with massive cash holdings and just 3.7% unemployment in November. Second, as of mid-September commercial bank deposits were $4.4 trillion higher than they were in January 2020, meaning that many households have a strong defense in the event of a downturn. Third, the banking system itself is in great shape. According to the FDIC, commercial bank net income in the third quarter totaled $71.7 billion.

With luck — a lot of luck — a recession might be avoided.

Speaking on 60 Minutes in December 2022, Treasury Secretary Janet Yellen explained that “there’s a risk of a recession. But it certainly isn’t, in my view, something that is necessary to bring inflation down.”

Translation: If things go right in such places as Ukraine and China, if oil prices remain low, we could have the softest of landings, a slowdown but not an outright recession. Unemployment would increase, but since we are already “at or beyond full employment” according to Yellen, relatively few jobs would be lost.

Commercial real estate as a hedge

Commercial real estate — with a few caveats — can be seen as an inflation hedge. It is, after all, a commodity, and commodities tend to automatically be re-priced during inflationary periods. Think about the recent prices you’ve seen in grocery stores.

Despite inflation, the work-from-home trend, and higher vacancy levels, commercial office rents have hardly budged. CommercialEdge reported in November 2022 that “across the top 50 U.S. office markets, the average full-service equivalent listing rate stood at $37.94 in October, down 0.1% year-over-year.” However, it also reported that rents were a solid hedge in a number of markets, up in Boston (12.2%), Charlotte (15.9%) and San Diego (14.5%).

Caveat #1: Location counts. Some markets will have more demand than others in the face of inflation, and vice versa.

How inflation impacts commercial real estate values

“2022 has been all about interest rates, and the negative impact they’ve had on values,” said Peter Rothemund, Co-Head of Strategic Research at Green Street. “The good news is that commercial property valuations have improved quite a bit over the past several weeks as bond yields have retreated. While pricing may continue to go down, the large moves should be behind us.” Commercial real estate leaders are opportunistic about innovation and continue to be hopeful that economic stability will happen sooner than later.

Caveat #2: Current values are most important when selling or refinancing, but many property owners are doing neither. Instead, they’re holding investments, looking for rising cash flow, and waiting for higher values.

Commercial real estate leases can offset Inflation

Commercial leases typically include annual increases to offset inflation levels and other costs. When inflation is marginal, as it was in 2019 (1.8%) and 2020 (1.2%), lease terms can enhance real results. However, when inflation levels reach the rates seen in 2021 (6.8%), annual lease increases may be insufficient to cover buying power losses.

Caveat #3: Commercial ownership tends to be a long-term investment, and investments — by their nature — include risk and the possibility of loss. The realistic measure of success is whether an investment produces a real profit and other benefits over time. No less important, slow markets may offer selected investment opportunities.

Inflation can benefit existing properties

Inflation may reduce competition and result in higher lease rates and property values. At first this may seem counter-intuitive, but if inflation means greater construction costs, steeper interest levels, and higher wage rates, then competing projects may be delayed or terminated, thus limiting nearby competition.

Caveat #4: Each property is unique. The result is that inflation and recession creates distinct results for individual projects.

Government can change the rules

Changes in government policy can directly impact commercial real estate economics, and the Inflation Reduction Act of 2022 (IRA) is an example of this. Under the legislation, $1.7 trillion will be spent over 20 years to address a variety of issues, including climate change and clean energy. The new legislation will create substantial opportunities for solar energy, decarbonization, and the retrofitting of older buildings.

Caveat #5: Keep your eye on Washington. Rules and standards are always subject to change. As they evolve, they create both new opportunities and new values. Think about the Superfund conversions that turned unusable but often well-located properties into viable commercial projects.

The emerging success profile for commercial real estate

Looking at properties around the country, those projects most likely to provide a hedge against inflation have several characteristics in common.

- They’re top-tier properties with excellent locations.

- The local market outperforms national averages.

- Automatic inflation adjustments help maintain cash flow and buying power.

- Properties are well-managed and reflect tenant preferences.

- Owners seek new subsidies and benefits when appropriate.

- As new technologies and social trends emerge, properties evolve to meet marketplace needs with advanced systems and features.

- Ownership seeks opportunities to work with local communities.

Going forward, much depends on the success of the Federal Reserve in its fight against inflation and what happens with such issues as the pandemic and the war in Ukraine. While there will be bumps in the road, KBS and the commercial real estate industry have endured despite numerous bouts of inflation and recession.

Learn more about commercial real estate, visit KBS.com/Insights.